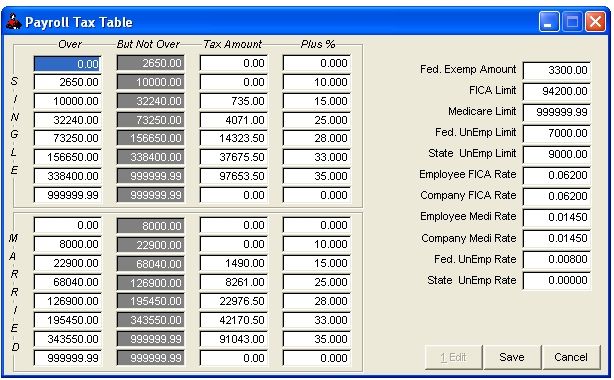

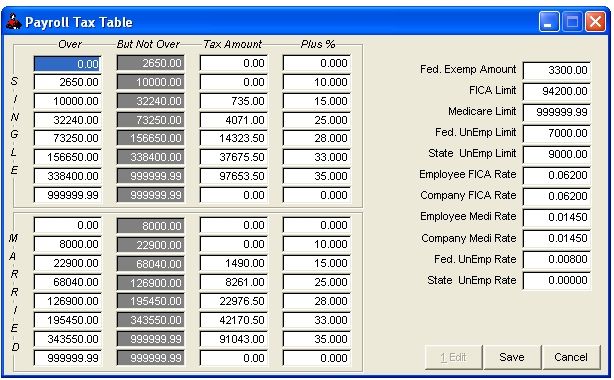

Payroll Tax Table

Select Master - Payroll Tax Table

The following table is current as of January 2006.

*State unemployment limit is different for each state.

Only edit is available for the tax table. You are not able to edit the “But Not Over” field. Roughneck updates that with the new tax table each year. The sample data that comes with the programs contain the latest tax tables for the current year. Tax tables are based on the year income rates for single and married persons as found in the IRS Circular E.

Notes on State Unemployment Limit and Rate: This is your state unemployment limit and experience rate assigned by your state. Each company's experience rate is different.

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.